Running a test VAT Return

In Season, to enter your company’s VAT Reg number, this can be set up by:

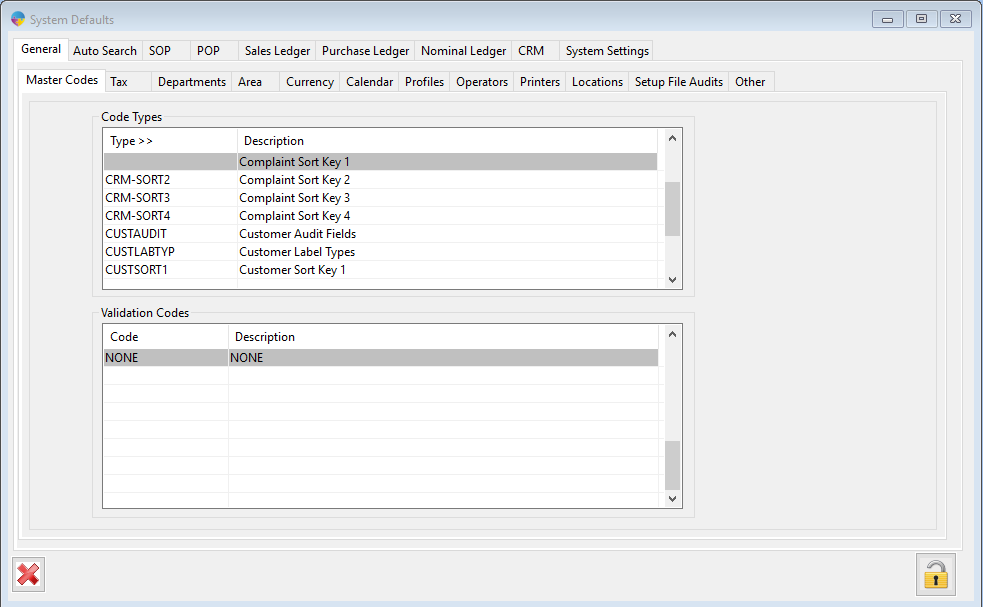

- Click on the top Season icon tab -> then Setup Office -> System Settings and Default codes.

As shown below, this will display the System Defaults page.

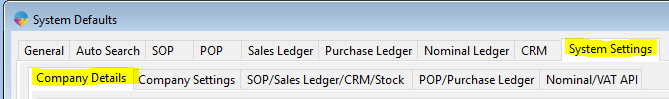

2. On the System Defaults page click on System Settings tab and then the Company Details tab.

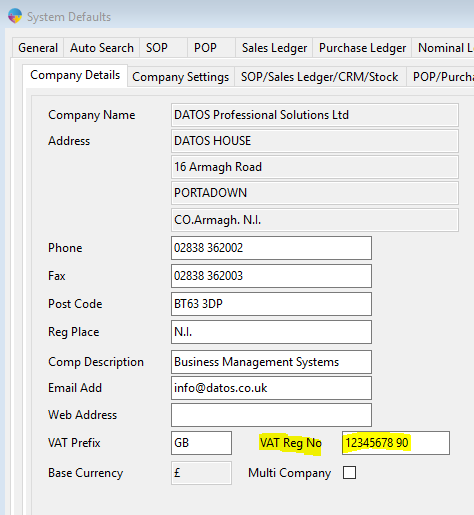

3. Next enter your company’s VAT Reg No, then save.

You are now ready to run your VAT Return in the Test Environment.

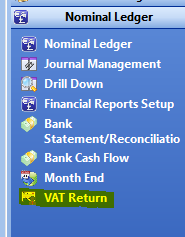

To run the VAT return:

- On the Operations menu, click on Nominal Ledger -> VAT Return. This will display the VAT Return page.

2. On the VAT Return page click the Start button to start the VAT Return.

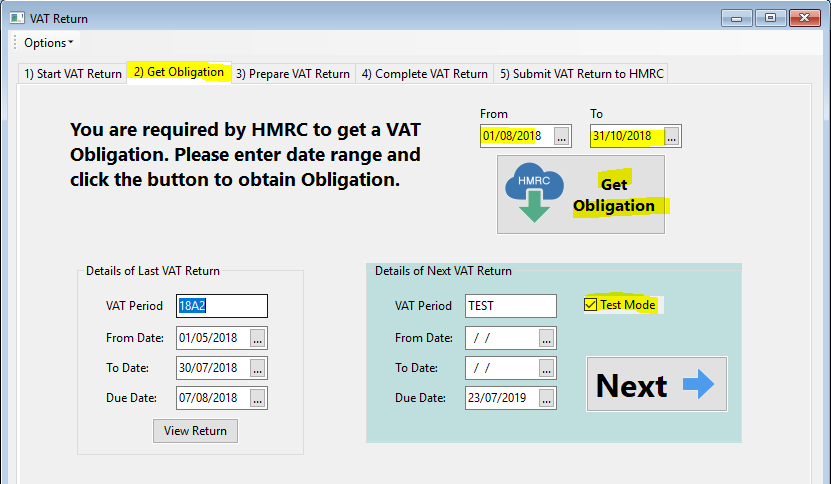

3. For the details of next VAT Return section tick the check box next to Test Mode.

4. Enter the date range and click the Get Obligation button.

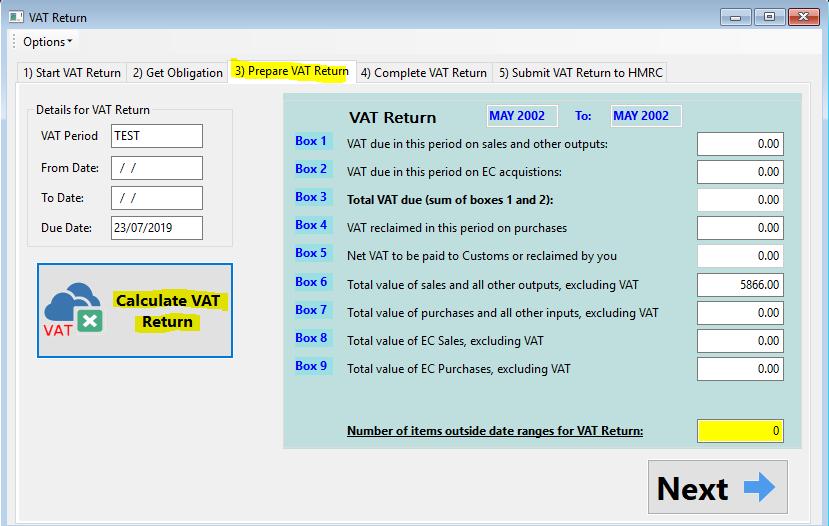

5. To prepare the VAT Return, click on the Calculate VAT Return button. This will calculate the VAT to be returned for the selected date range.

6. Click the Next button to continue to the Complete VAT return section.

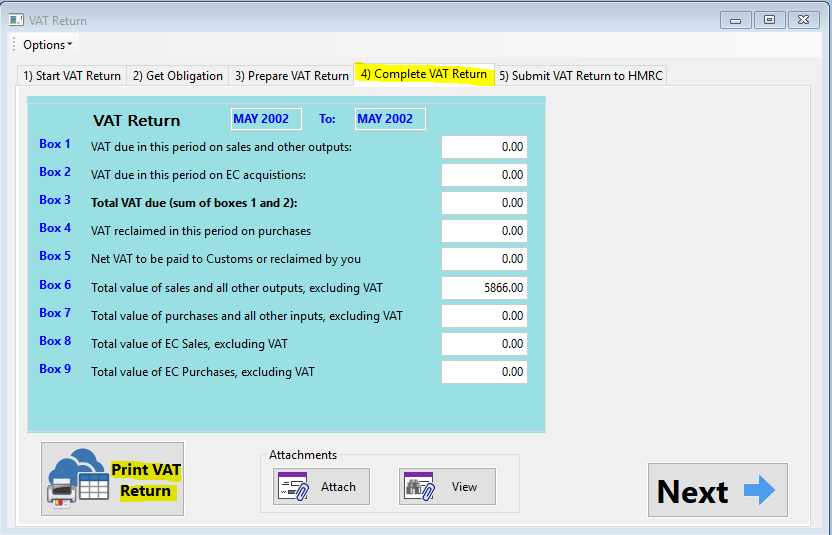

7. On the Complete VAT Return page, you can print the VAT Return for the date range you selected by clicking on the Print VAT Return button.

8. Click the Next button to continue to submitting the VAT return to HMRC.

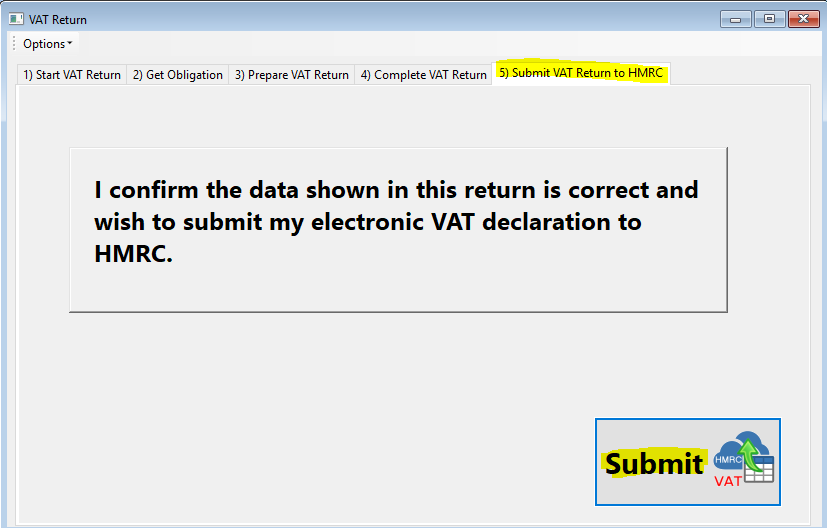

9. On the Submit VAT Return to HMRC page, you can confirm the VAT return by clicking on the Submit button.

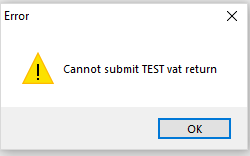

10. Because this is the test environment, the VAT Return cannot be submitted.

VAT Analysis Report – After you have ran a test return, you are able to run a VAT analysis report for that return. To find out how to do so, follow this link.