Changes to Nominal Receipt Entry

With the release of Season 19 comes changes to the nominal receipt entry facility. These changes now enable you to add VAT and a VAT code against your nominal receipt. If you are using a version older than 19, please follow this link for more on a how to enter nominal receipts.

First you will need to open your Receipts Other window in Season. This is found under the Sales Ledger tab on your right hand Operations menu.

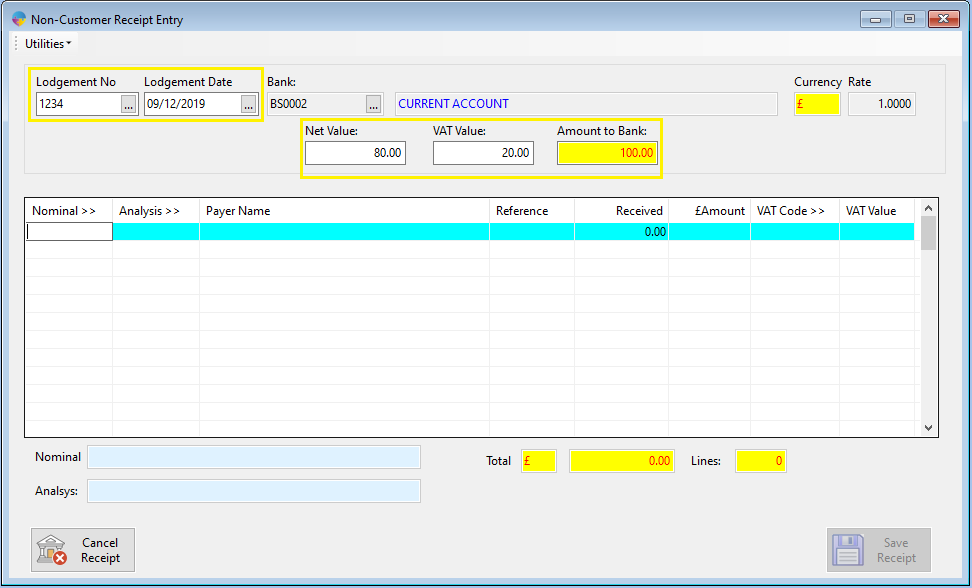

- First you will need to add a Lodgement No, Select a Lodgement Date and choose the Bank this receipt is being posted to.

- Next, enter the NET Value and VAT Value, this acts as a control total. (if your grid totals do not match the Amount to Bank, Season will not let you save the receipt)

- Now click into the Nominal field and press F4, this will bring up your Nominal code list, Select a relevant code and click the green tick. (**Please note, you are no longer able to post directly to a bank account nominal**)

- Moving on, add an Analysis Code if required, a Payer Name, a Reference and the total Received.

- Now you will add your VAT Code, click the VAT CODE field and press F4 to open your VAT Code list. Select a code and click the green tick.

- Add your VAT Value and click Save Receipt.